Table of Contents

Introduction

PBIP Stock is Prudential Bancorp, Inc. functions as the bank property corporation for Prudential Bank, offering many banking goods or services. The company admits interest-bearing and non-interest-behavior examination, money market, savings, and diplomas of deposit accounts.

Its loan collection includes single-family built-up loans, building, and land growth loans, non-uptown or profitable real estate advance loans, home impartiality loans

Prudential Bank Prudential Bancorp, Inc.

CEO: Dennis Pollack, MBA

Headquarters: Philadelphia, Pennsylvania

Address: 1834 West Oregon Avenue, Philadelphia, PA 19145, United States

Country: USA

Originated: 1886

Sector: Financials

Site: https://www.psbanker.com

About PBIP

Prudential Savings Bank is a Penn-rented savings bank first prepared in 1886 as a Pennsylvania chartered common building and loan suggestion. We were formerly known as ”The South Philadelphia Structure and Loan Suggestion No. 2”. We changed to a joint savings bank in August 2004

WHat is Pbip stocks?

PBIP Stock is prudential Bancorp, Inc saving bank; it is trading with R stock charts investing in Prudential Bancorp Inc. Real stock and CFD on the stock of America and Europe company or a bank with R Stock trader

PBIP Key Statistics

Market cap

117.66M

Average volume

25.39K

52 Week High

$17.43

52 Week low

$13.25

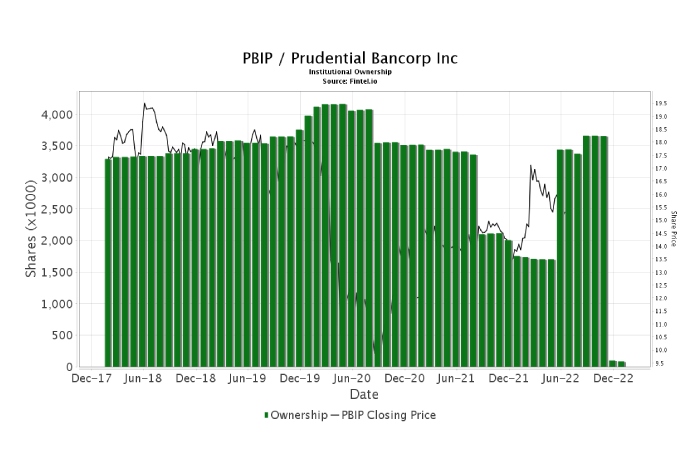

Pbip Share Price

2023-01-27

Price: $15.13

2018-06-21

The highest end-of-day price: is $ 19.76

2011-11-10

The lowest end-of-day price: is $5.08

COmpiteter for PBIP Stocks

Comparing PBIP Stock with others, prudential Bancorp Inc informed Over-all Income increased in the two headquarters in 2020 by 12.36, while the competitors have a skilled reduction in revenues by -18.23 %, noted in the similar headquarter

Prudential Bancorp Inc’s response to his Competitors

This competition branches mainly from profitable banks, credit unions, other savings banks, savings relations, and loan-banking companies. Many of the economic service earners working in the market area are knowingly more

Financial capital, then Prudential Bancorp Inc. Prudential Bancorp Inc face extra competition for deposits short-term money market funds and other corporate and government securities funds, mutual funds.

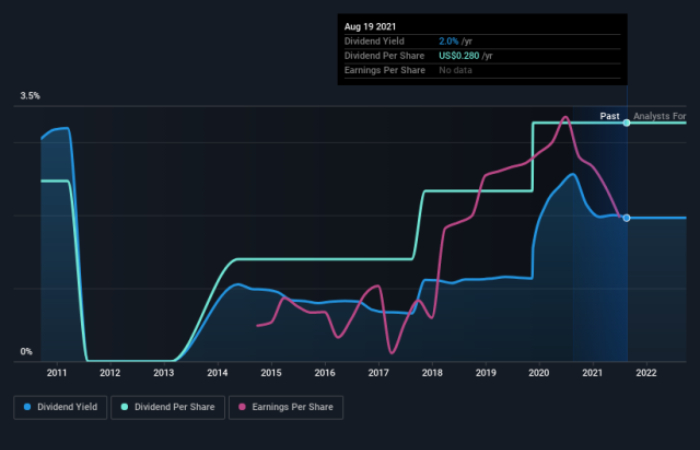

PBIP stocks dividend |

| Market Capitalization, $K117,655 |

| Shares Outstanding, K7,776 |

| Annual Sales, $41,680 K |

| Yearly Income, $7,780 K |

| 60-Month Beta0.06 |

| Price/Sales2.85 |

| Price/Cash Flow17.68 |

Fulton Financial Corporation Completes Acquisition of Prudential Bancorp, Inc.

Fulton Financial Corporation broadcast the positive completion of its gaining of Prudential Bancorp, Inc., headquartered

First Bancorp (FBNC) to Acquire GrandSouth in All-Stock Deal

First Bancorp (FBNC) symbols an absolute union contract to obtain GrandSouth Bancorporation in a $181.1-million deal to hurry its South Carolina growth.

KNow about Prudential Bancorp inc

The support by Prudential Bancorp shareholders, combined with receiving “We forestall the transaction will be completed in July, agreeing on Fulton to comfortable Prudential Bank members

The bank property company for Fulton Bank (www.fultonbank.com) united properties of about $26 billion and offered financial facilities over 200 financial hubs in Pennsylvania, Delaware, Maryland, New Jersey and Virginia

The following risks, worries and Assumptions:

- The opportunity that the expected profits of the deal, with projected cost savings and planned gains, are not appreciated when predictable as an outcome of the effect of or tasks arising

- The timing and completion of the merger transaction are dependent on the satisfaction of closing conditions contained in the Merger Agreement;

- The amount of any occasion, other or other conditions that can give increase to the truth of one or together of the gatherings to dismiss the Union Contract

- Probable opposing responses or other changes in a company, like business, and employee relationships, with those subsequent from the statement or conclusion of the union

- The result of any legal reports related to the union which may be started against Fulton or Prudential Bancorp

Conclusion

Prudential Bancorp, Inc. is the business enterprise company for Prudential Bank. Prudential Bank is a Pennsylvania-rented, FDIC-protected savings bank prepared in 1886. The Bank behaviours business from its headquarters and key office in Philadelphia, Pennsylvania, as well as ten extra full-service financial centers.